PROACTIVE INTERNAL AUDITING & CORP. INVESTIGATIONS

Organizations must adhere to strict standards, including financial regulations, workplace policies, and ethical practices. In Ohio, companies are subject to state and federal laws such as the Sarbanes-Oxley Act (SOX), Foreign Corrupt Practices Act (FCPA), False Claims Act, and other regulations to prevent fraud, corruption, and corporate misconduct.

At Gregory J. Vincent Law, we help businesses establish proactive risk management strategies, conduct thorough internal audits, and ensure compliance with regulatory bodies such as the SEC, DOJ, and state oversight agencies. If an investigation is launched, we provide rigorous employment & labor representation, strategic advocacy, and response management to safeguard your organization.

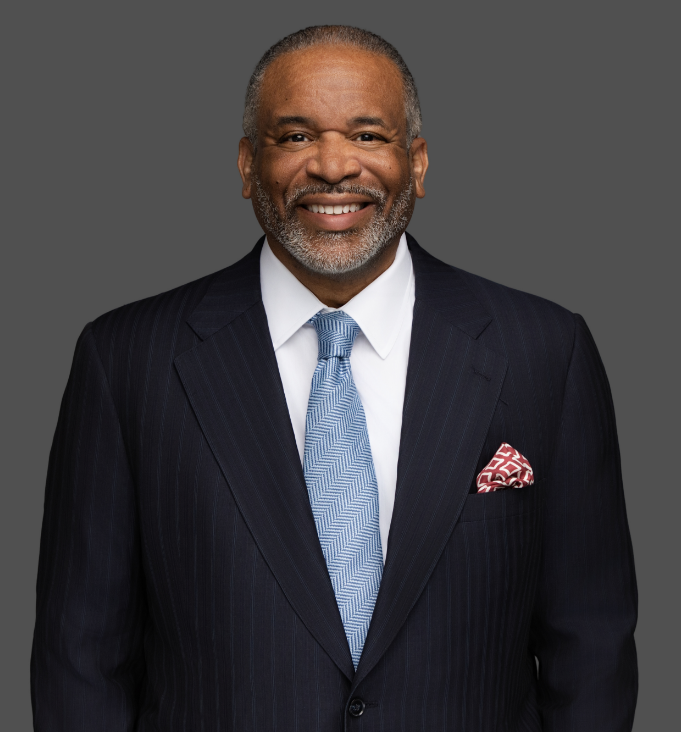

Dr. Vincent – Ohio’s Trusted Corporate Investigation Attorney

With decades of experience in corporate compliance, regulatory enforcement, and internal investigations, Dr. Gregory J. Vincent has played a key role in shaping corporate accountability standards.

As a former Ohio Assistant Attorney General, he led corporate fraud investigations, advised businesses on regulatory compliance, and defended organizations facing high-profile inquiries.

Dr. Vincent’s career spans corporate governance, financial oversight, and institutional ethics. He has provided legal counsel to executives, business leaders, and government agencies.

- Former Ohio Assistant Attorney General

- Senior Compliance Counsel, National Business Ethics Council

- Executive Director, Corporate Governance & Compliance Initiative

- Former Vice President & Legal Affairs Chair, University of Texas at Austin

- 2017 Corporate Ethics Leadership Award

- 2023 Business Integrity Excellence Award

- Kentucky Colonel, bestowed by the Governor of Kentucky

- Grand Sire Archon (Chairman and CEO) 2018-2020 Sigma Pi Phi Fraternity Inc

Recognized for his depth of knowledge and pragmatic approach, Dr. Vincent is committed to ensuring legal clarity and helping businesses maintain ethical and compliant operations.

Corporate Investigations & Audit Services

As a corporate investigation attorney, Dr. Vincent provides comprehensive legal strategies to prevent, address, and defend against allegations of corporate misconduct.

Financial Fraud & White-Collar Investigations

We help businesses detect, investigate, and respond to financial fraud allegations, ensuring compliance with SEC and DOJ regulations.

Internal Investigations & Corporate Misconduct

We conduct internal audits to uncover potential misconduct, prevent liability, and implement corrective action plans.

Regulatory Compliance & Risk Management

We advise organizations on compliance with federal and state regulations, mitigating legal exposure, and ensuring adherence to industry standards.

Employee Misconduct & Workplace Investigations

We assist businesses in addressing workplace misconduct, harassment claims, and internal policy violations while ensuring proper legal protocols are followed.

Government & SEC Investigations

We provide legal representation and strategic defense for businesses facing regulatory inquiries, government subpoenas, and SEC investigations.

Data Security & Privacy Compliance

We help companies develop policies to prevent data breaches and ensure compliance with privacy regulations, including GDPR and HIPAA.

Ethics & Corporate Governance

We guide boards, executives, and compliance officers in developing and enforcing ethical business practices that align with legal requirements.

Whistleblower Defense & False Claims Act

We represent businesses facing whistleblower claims, helping navigate legal risks under the False Claims Act and similar statutes.

Compliance is Your Strongest Corporate Defense

Taking proactive steps to prevent corporate misconduct is essential. Neglecting compliance can result in financial penalties, operational disruptions, and reputational damage. As a business leader, implementing strong investigative and audit practices ensures transparency, minimizes legal risk, and fosters an ethical corporate culture.

Get in TouchFREQUENTLY ASKED INTERNAL INVESTIGATION QUESTIONS

What Laws Regulate Corporate Investigations?

- Sarbanes-Oxley Act (SOX) (2002) – Establishes financial reporting and audit requirements for publicly traded companies to prevent fraud.

- Foreign Corrupt Practices Act (FCPA) (1977) – Prohibits bribery of foreign officials and enforces corporate accounting transparency.

- False Claims Act (FCA) (1863) – Protects whistleblowers and penalizes fraudulent claims for government contracts.

- Dodd-Frank Act (2010) – Strengthens financial regulations and promotes corporate accountability to prevent economic fraud.

- General Data Protection Regulation (GDPR) (2018) – Regulates data privacy and security for businesses handling consumer information.

- Ohio Revised Code Corporate Compliance Regulations – Outlines state-level corporate governance and fraud prevention requirements.

How Should My Business Handle Internal Investigations?

Companies must act swiftly when facing internal complaints or external regulatory scrutiny. A structured response includes conducting a thorough investigation, documenting findings, consulting legal counsel, and implementing necessary compliance measures to mitigate risk.

Can Internal Audits Prevent Legal Liability?

Yes. Regular internal audits help identify vulnerabilities, ensure compliance with financial and operational regulations, and reduce the risk of regulatory penalties or litigation.

What Should I Do If My Business Is Under Investigation?

Seek legal counsel immediately. Responding improperly to government or regulatory investigations can escalate penalties and legal exposure. Gregory J. Vincent Law provides strategic defense and compliance guidance to navigate investigations effectively.

.