CLEAR GUIDANCE & SUPPORT FOR TAX-EXEMPT ORGANIZATIONS

Tax-exempt organizations operate under strict regulatory frameworks enforced by the IRS, state agencies, and other governing bodies. Noncompliance can lead to penalties, loss of tax-exempt status, and even litigation. In Ohio, organizations must adhere to Section 501(c) of the Internal Revenue Code, state nonprofit laws, and industry-specific compliance standards.

At Gregory J. Vincent Law, we provide proactive legal strategies for tax-exempt entities, assisting with formation, compliance, governance, and defense against IRS audits and legal disputes. Our lawyers help nonprofits, charities, and religious organizations maintain their status, mitigate legal risks, and confidently uphold their mission.

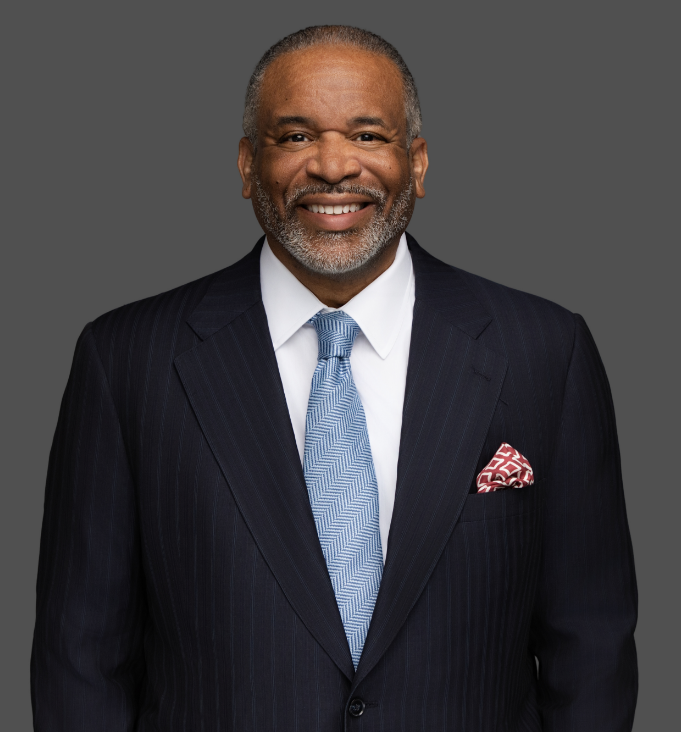

Dr. Vincent – Ohio’s Leader in Tax Exemption Law

With a distinguished career in nonprofit governance, tax law, and public policy, Dr. Gregory J. Vincent is a nationally recognized advocate for cause-driven organizations.

His background in higher ed, corporate law, and nonprofit administration gives him unique insight into the legal and regulatory challenges tax-exempt entities face.

As a former Ohio Assistant Attorney General, Dr. Vincent has successfully handled tax-exempt compliance cases, IRS disputes, and nonprofit regulatory matters, ensuring that organizations remain legally sound while focusing on their mission.

- Former Ohio Assistant Attorney General

- Grand Sire Archon (Chairman and CEO) 2018-2020 Sigma Pi Phi Fraternity Inc

- Senior Counsel, National Diversity Council

- Executive Director, Education & Civil Rights Initiative, University of Kentucky

- Former Vice President & Professor of Law, University of Texas at Austin

- 2017 Champion of Change Award

- 2023 Dr. Theodore Judson Jemison President’s Award

Dr. Vincent’s dedication to public service and nonprofit advocacy makes him a trusted legal partner for tax-exempt organizations in Ohio and beyond.

Legal Services for Tax-Exempt Organizations

At Gregory J. Vincent Law, we provide clear, actionable guidance to help tax-exempt organizations obtain, manage, and protect their status while remaining compliant with tax laws and regulations.

Nonprofit Formation & 501(c) Tax Exemption

We assist with establishing nonprofits, filing IRS Form 1023, IRS form 1024, and structuring tax-exempt organizations to meet federal and state requirements.

Corporate Governance & Compliance

We guide boards, officers, and executives in fulfilling fiduciary duties, maintaining corporate records, and adhering to nonprofit governance best practices.

IRS Audits & Investigations

If your organization faces an IRS audit, compliance check, or legal challenge, we provide strategic defense and advocacy to protect your tax-exempt status.

Charitable Solicitation & Fundraising Compliance

We ensure your organization adheres to Ohio’s charitable solicitation laws and federal fundraising regulations, reducing risks associated with donations and grant funding.

Religious & Faith-Based Organizations

We assist churches, religious schools, and faith-based charities with First Amendment protections, tax compliance, and employment policies tailored to their mission.

Private Foundations & Endowments

We advise private foundations on self-dealing restrictions, grantmaking compliance, and excise tax regulations to avoid IRS penalties.

UBIT & Revenue Compliance

We help organizations manage unrelated business income (UBI), commercial ventures, and sponsorship agreements to maintain tax-exempt status while generating revenue.

State & Federal Reporting Requirements

We provide guidance on annual IRS Form 990 filings, Ohio nonprofit reporting requirements, and compliance with state charitable registration laws.

Compliance is Key to Protecting Your Tax-Exempt Status

Failure to comply with IRS regulations, Ohio nonprofit laws, or fundraising disclosure rules can result in penalties, reputational damage, and even revocation of tax-exempt status. Nonprofits, charities, and religious orgs must have strong internal policies, proper tax filings, and board structures to remain in good standing. Our nonprofit attorney helps organizations navigate these complexities so they can focus on serving their mission.

Get in TouchFREQUENTLY ASKED NONPROFIT TAX-EXEMPTION QUESTIONS

What Are the Key Requirements for 501(c)(3) Status?

To qualify as a 501(c)(3) tax-exempt organization, an entity must:

- Be organized and operated exclusively for charitable, educational, religious, or scientific purposes.

- Refrain from political campaign activity and excessive lobbying.

- Ensure that earnings do not benefit private individuals or shareholders.

- Properly file IRS Form 1023 (or 1023-EZ) and comply with annual IRS Form 990 filing requirements.

What Happens if a Nonprofit Violates IRS Rules?

If a nonprofit fails to comply with IRS regulations, it could face:

- Revocation of tax-exempt status

- Excise taxes or penalties

- Legal action from the IRS or state authorities

- Damage to donor confidence and funding sources

Proper compliance strategies can help organizations avoid these risks and operate legally.

How Can a Nonprofit Avoid Losing Its Tax-Exempt Status?

To maintain tax-exempt status, nonprofits should:

- File annual IRS Form 990 and required state reports.

- Follow nonprofit corporate governance best practices.

- Avoid excessive unrelated business income (UBI) that triggers taxation.

- Ensure compliance with fundraising and donation regulations.

What Is Unrelated Business Income Tax (UBIT)?

Unrelated Business Income Tax (UBIT) applies when a tax-exempt organization earns revenue from activities not related to its exempt purpose. Examples include:

- Selling merchandise unrelated to the nonprofit’s mission.

- Operating a for-profit business within the nonprofit.

- Accepting advertising revenue beyond passive sponsorships.

Organizations must carefully structure revenue-generating activities to avoid unexpected tax liabilities.